All Categories

Featured

Table of Contents

They normally give an amount of protection for much less than long-term types of life insurance policy. Like any policy, term life insurance coverage has advantages and drawbacks depending on what will certainly work best for you. The advantages of term life consist of affordability and the capacity to personalize your term length and insurance coverage amount based upon your needs.

Depending on the type of plan, term life can offer set costs for the whole term or life insurance coverage on level terms. The fatality benefits can be fixed.

Level Term Life Insurance Meaning

Fees reflect plans in the Preferred And also Price Course concerns by American General 5 Stars My representative was really knowledgeable and valuable in the process. July 13, 2023 5 Stars I was satisfied that all my needs were fulfilled promptly and skillfully by all the representatives I spoke to.

All documentation was electronically finished with access to downloading for personal data maintenance. June 19, 2023 The endorsements/testimonials provided must not be construed as a referral to purchase, or an indication of the worth of any service or product. The reviews are actual Corebridge Direct consumers who are not affiliated with Corebridge Direct and were not given compensation.

2 Cost of insurance policy rates are determined making use of methods that vary by business. It's vital to look at all variables when assessing the general competitiveness of rates and the value of life insurance policy coverage.

Innovative Term Life Insurance With Accelerated Death Benefit

Nothing in these materials is intended to be guidance for a particular circumstance or person. Please seek advice from with your very own advisors for such recommendations. Like most group insurance coverage, insurance plan used by MetLife have specific exemptions, exceptions, waiting durations, reductions, restrictions and terms for maintaining them in force. Please contact your benefits administrator or MetLife for costs and complete information.

Essentially, there are two sorts of life insurance policy intends - either term or permanent plans or some combination of the 2. Life insurers offer various types of term strategies and conventional life policies in addition to "rate of interest delicate" items which have come to be more prevalent because the 1980's.

Term insurance policy supplies protection for a specified period of time. This period can be as short as one year or supply coverage for a particular number of years such as 5, 10, two decades or to a defined age such as 80 or in many cases as much as the earliest age in the life insurance death tables.

Expert Group Term Life Insurance Tax

Presently term insurance policy rates are very affordable and among the most affordable historically experienced. It must be noted that it is an extensively held idea that term insurance coverage is the least costly pure life insurance policy protection available. One requires to review the plan terms meticulously to choose which term life choices appropriate to satisfy your certain scenarios.

With each new term the premium is increased. The right to renew the plan without evidence of insurability is an essential advantage to you. Or else, the danger you take is that your wellness may weaken and you may be unable to get a policy at the very same rates and even whatsoever, leaving you and your recipients without insurance coverage.

The length of the conversion duration will certainly differ depending on the kind of term policy purchased. The premium rate you pay on conversion is usually based on your "existing acquired age", which is your age on the conversion day.

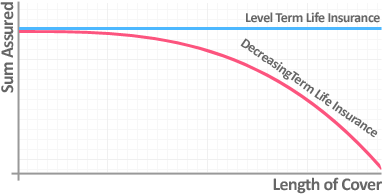

Under a level term policy the face quantity of the plan continues to be the very same for the entire duration. With reducing term the face amount minimizes over the duration. The premium remains the exact same yearly. Commonly such plans are sold as home mortgage defense with the amount of insurance decreasing as the balance of the home mortgage reduces.

Generally, insurance providers have actually not can alter premiums after the policy is marketed (the combination of whole life and term insurance is referred to as a family income policy). Since such plans might proceed for years, insurers have to utilize conventional death, rate of interest and cost rate estimates in the costs computation. Flexible premium insurance coverage, however, enables insurance firms to supply insurance policy at lower "present" premiums based upon less traditional assumptions with the right to change these costs in the future

Best What Is Decreasing Term Life Insurance

While term insurance is designed to supply security for a specified period, permanent insurance coverage is created to give protection for your whole life time. To maintain the premium rate level, the costs at the younger ages exceeds the real cost of defense. This added premium develops a get (cash worth) which assists spend for the plan in later years as the price of protection rises above the costs.

Under some plans, costs are called for to be paid for an established variety of years. Under other policies, premiums are paid throughout the insurance policy holder's lifetime. The insurance firm invests the excess premium bucks This kind of policy, which is in some cases called cash money value life insurance policy, generates a cost savings aspect. Cash worths are vital to a long-term life insurance plan.

Secure Level Term Life Insurance

Often, there is no relationship in between the dimension of the money worth and the costs paid. It is the money value of the plan that can be accessed while the policyholder is alive. The Commissioners 1980 Standard Ordinary Mortality (CSO) is the present table utilized in determining minimum nonforfeiture values and policy gets for normal life insurance plans.

There are two fundamental categories of permanent insurance policy, conventional and interest-sensitive, each with a number of variants. Traditional whole life plans are based upon long-term estimates of expense, interest and mortality (term 100 life insurance).

If these estimates change in later years, the business will readjust the premium as necessary but never above the optimum guaranteed premium specified in the plan. An economatic entire life plan provides for a standard quantity of getting involved whole life insurance policy with an extra supplementary coverage offered via the use of dividends.

Due to the fact that the costs are paid over a much shorter span of time, the costs repayments will be higher than under the whole life plan. Single costs entire life is restricted settlement life where one big superior payment is made. The policy is fully paid up and no more costs are needed.

Latest Posts

Paying Funeral Expenses With Life Insurance

Metlife Final Expense Policy

Funeral Expense Insurance Policy