All Categories

Featured

Table of Contents

It permits you to budget plan and prepare for the future. You can quickly factor your life insurance policy right into your budget plan because the premiums never transform. You can plan for the future just as easily because you recognize precisely just how much money your liked ones will obtain in case of your lack.

This is true for people that stopped cigarette smoking or who have a wellness problem that resolves. In these instances, you'll typically need to go via a new application procedure to get a far better price. If you still require coverage by the time your degree term life policy nears the expiration day, you have a couple of options.

Most level term life insurance policy plans include the choice to restore coverage on an annual basis after the first term ends. what is direct term life insurance. The expense of your policy will certainly be based on your existing age and it'll increase yearly. This can be a great alternative if you just need to expand your protection for 1 or 2 years otherwise, it can get expensive rather swiftly

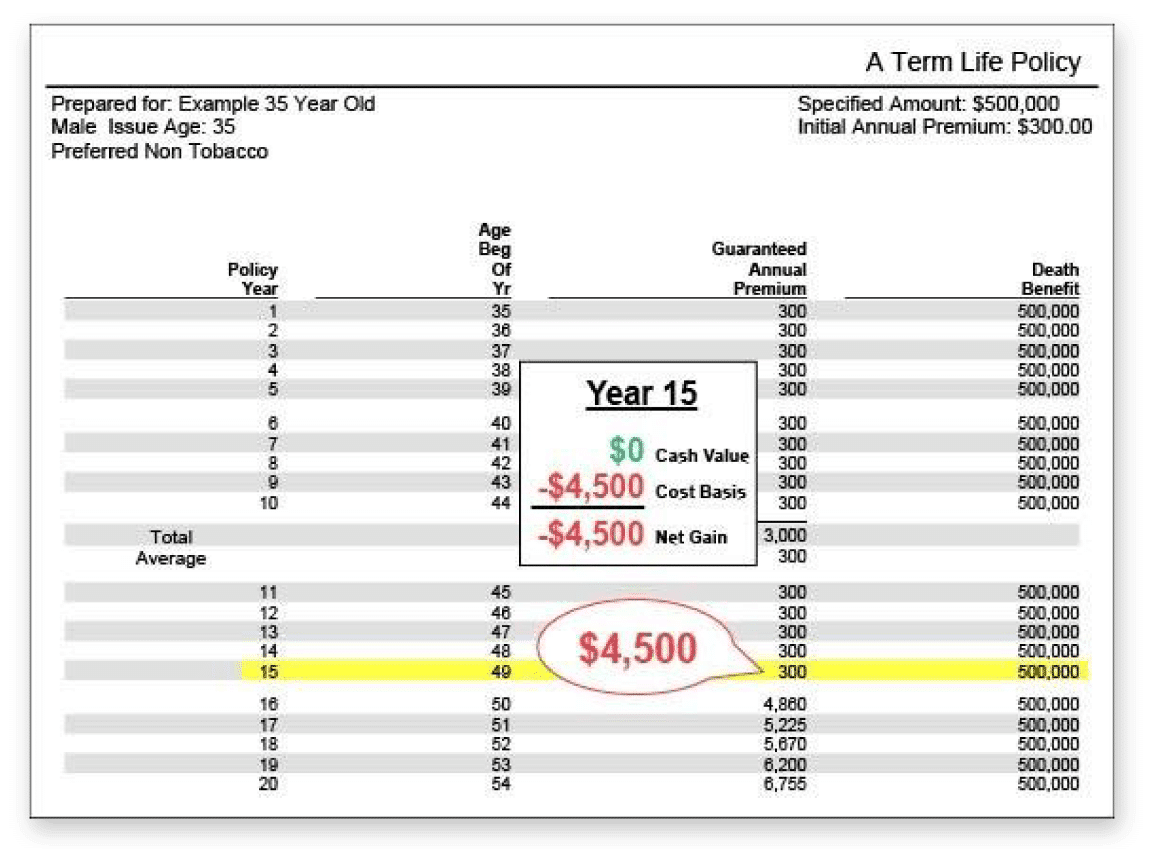

Degree term life insurance is one of the cheapest coverage options on the marketplace because it supplies fundamental defense in the form of fatality advantage and only lasts for a set duration of time. At the end of the term, it expires. Whole life insurance, on the other hand, is dramatically more pricey than degree term life due to the fact that it does not end and comes with a money value attribute.

Secure Does Term Life Insurance Cover Accidental Death

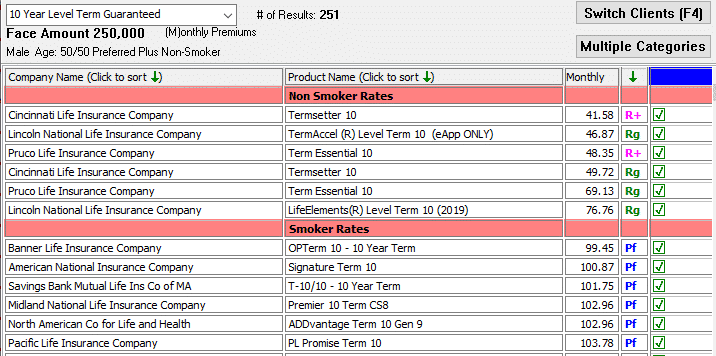

Prices might differ by insurer, term, coverage quantity, wellness course, and state. Degree term is a fantastic life insurance choice for most people, but depending on your coverage needs and individual scenario, it could not be the finest fit for you.

This can be a good option if you, for example, have just quit smoking and require to wait two or 3 years to use for a level term policy and be eligible for a reduced price.

Long-Term Term Life Insurance With Accelerated Death Benefit

, your fatality benefit payment will certainly lower over time, yet your settlements will stay the very same. On the other hand, you'll pay more in advance for less coverage with a raising term life policy than with a level term life plan. If you're not certain which kind of plan is best for you, working with an independent broker can assist.

When you have actually chosen that degree term is ideal for you, the following action is to acquire your plan. Here's exactly how to do it. Determine exactly how much life insurance policy you need Your coverage amount need to offer for your family members's lasting economic requirements, consisting of the loss of your earnings in case of your death, as well as debts and everyday costs.

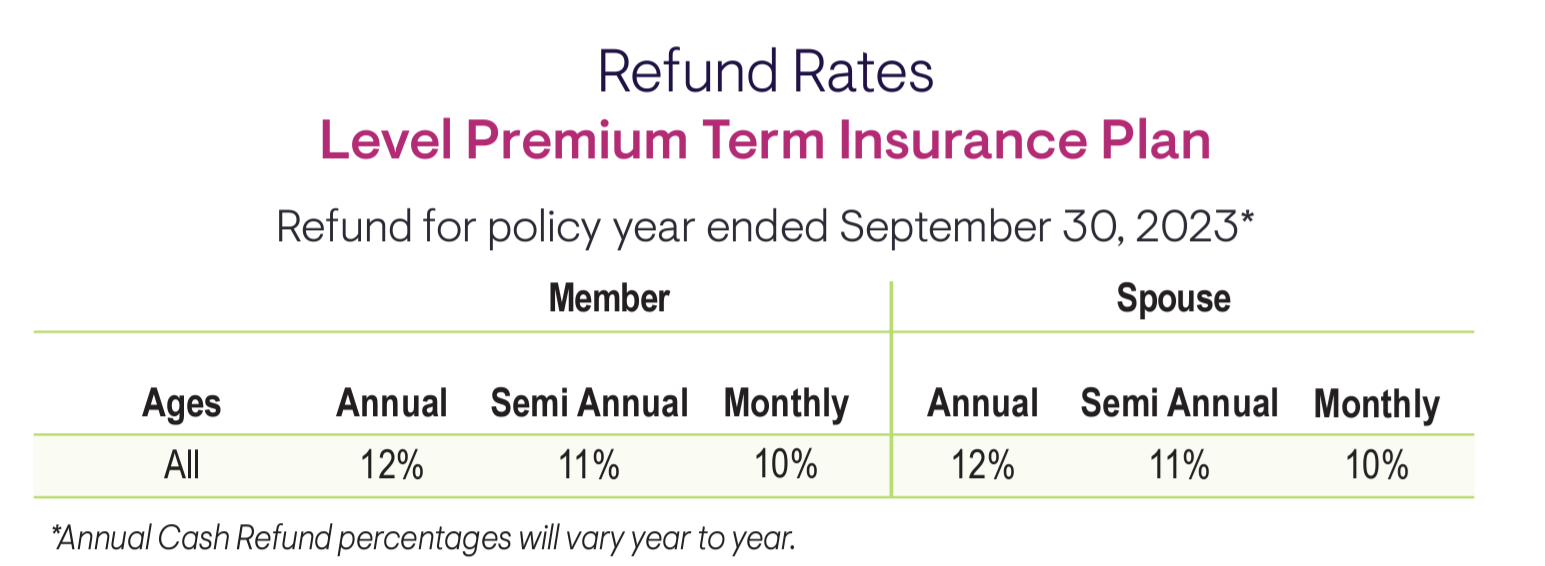

A degree premium term life insurance policy strategy allows you stick to your budget while you aid shield your family. ___ Aon Insurance Services is the brand name for the brokerage firm and program administration operations of Fondness Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Agency, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Services Inc.; in CA, Aon Fondness Insurance Coverage Solutions, Inc.

The Plan Agent of the AICPA Insurance Coverage Depend On, Aon Insurance Coverage Providers, is not associated with Prudential.

Latest Posts

Paying Funeral Expenses With Life Insurance

Metlife Final Expense Policy

Funeral Expense Insurance Policy